Research

Research is the driving force behind our campaigning and policy work.

Research

Covid-19 Response Programme Evaluation Report

03 Nov 2022

Learn about our Covid-19 Response Programme evaluation.

Research

Life events research

22 Nov 2021

In 2021 we undertook research to understand the impact of life events on people’s finances, how they cope, and what measures they need to support them.

Research

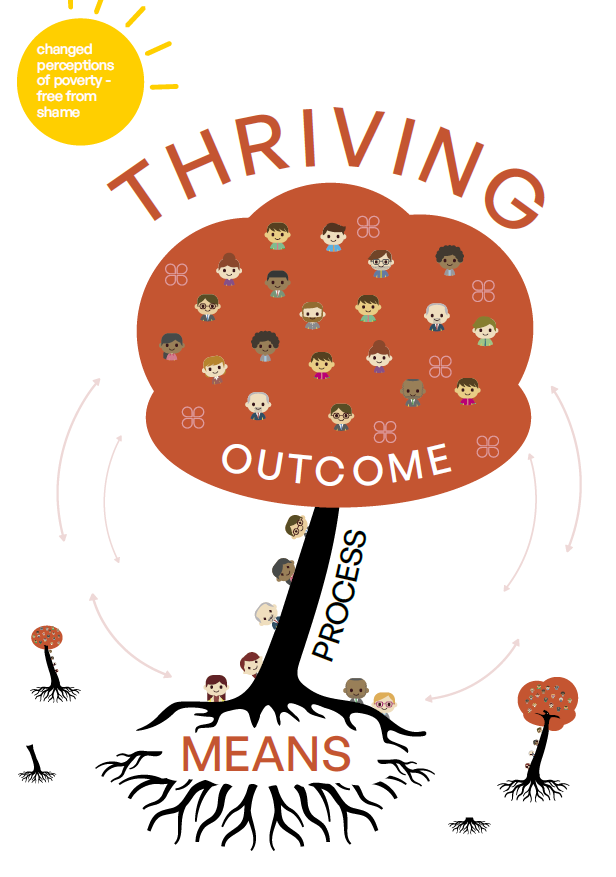

Our Model of Thriving

25 Oct 2021

Turn2us, The Bennett Institute for Public Policy and people with lived experience of financial hardship looked into what it means to thrive.

Research

Financial Resilience research

13 Nov 2020

This report looks at the impact of Covid on our collective financial resilience.

Research

Research briefings

17 Jun 2020

Research

Coronavirus Insight Reports

17 Apr 2020

Research

Living Without campaign

16 Jan 2020

Read our research into the daily impact of living without essential appliances, and solutions to appliance poverty.

Research

APPG on Universal Credit

11 Jul 2019

Research

Two-child Limit

13 Jun 2019

Research

Our submissions

11 Oct 2017

Support Turn2us

By donating, you can help ensure families can eat enough and keep the lights on.